- (651) 552-3681

- Joe.Metzler@CambriaMortgage.com

- 33 Wentworth Ave E, St Paul, MN 55118

We’re passionate about making sure you get the right home loan for your needs.

First Time Home Buyer Basics

Everything you need to know to buy your first house.

If you are like most people, purchasing a home is likely the largest single financial transaction of your life. Because of this, it is very important to work with a licensed and very experienced local Loan Officer who will show you the ropes, explain everything, and guide you to a successful closing.

There are many different first time home buyer programs, along with various down payment assistance programs. Many factors come into play to determine which programs work best for you. including your credit, property location, debt-to-income ratio’s, and more.

Determining which program is right for is sometimes hard for mortgage professionals, let alone a typical home buyer. We suggest you stop trying to figure it out on your own, and let our expert do it for you.

Typical assistance comes comes in two forms: A first time home buyer program, and/or a down payment assistance program.

Common elements may include below standard market interest rates, reduced private mortgage insurance costs, smaller down payment requirements, expanded debt-to-income ratio’s, and the most popular part, down payment assistance.

The programs are typically offered by local mortgage lenders like us, and almost never by the big banks or big internet companies. They usually are offered in conjunction with Federal, State City, or County government entities, and some non-profits and corporations.

We’ve created the following video to teach you everything you need to know about buying your first home.

Great Rates, Low Costs, Awesome Service OUR TOP PRIORITY

Basic Home Buying Steps

How It Works

We start with a simple 10-15 minute loan application with your name, birthdate, job, income, etc.

1. The ApplicationYour Loan Officer will go over your options, talk about how much house you can afford, what payments might look like, etc.

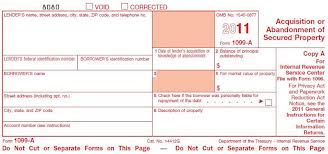

2. Loan ReviewWe will gather your documents, like pay stubs, W2's, and bank statements. We will order appraisals, and job verifications. Then an underwriting will look at everything.

3. Processing/ UnderwritingOnce everything has been reviewed, the Underwriter will sign off on everything, and give an all Clear-to-Close. next you will sit at the closing table, sign all the loan paperwork, and get handed the keys to your new home.

4. Final ApprovalWE ENJOY HELPING YOU

Why People Choose Us

Experienced Loan Officers

Most people don't put much thought into it, but a rookie versus an experienced Loan officer can make or break your home buying process.

Professional Review

Our professional Loan Officers will look not just at one program, but rather a whole suite of programs to make sure you are getting the right loan for you and your family

We Stay In Touch

Communication throughout the process is key. We call you a minimum of once a week with your loan status, plus you receive milestone updates, and you can always check your loan status on our mobile app.

On Time Closings

There is nothing more heartbreaking than not closing on your new home on the the scheduled day and time. We just don't let that happen!

MEET THE PROFESSIONALS

Related Services

We reward money-saving real estate program for home buyers and sellers.

We refinance our clients as rates change quickly and people need help.

Credit is a financial instrument used to help clients short of budget.

Own success at every turn. Uncover and deliver on opportunities that build lasting value.

Questions? We'll Put You On A Right Path!

Buying a house can feel scary and overwhelming, but we work hard to make the process easy, and are happy to answer all your questions!

NEWSLETTER SIGNUP

Get exclusive deals, and up to date information on mortgage rates and the real estate market

RECENT POSTS

HOW CAN WE Help You?

Have questions? Our experienced licensed loan officer team can help you achieve your dream of home ownership.

ABOUT US

Loan Officers Joe and Eric Metzler have over 50-years combined mortgage landing experience. Experience you can trust to make your dream of home ownership come true with a simple, and stress free process.